Thursday, 1 March 2012

German cabinet minister calls for Greek euro exit

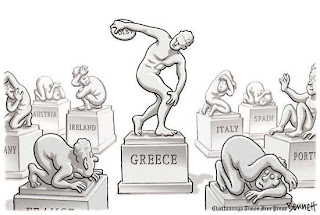

Germany’s interior minister called for Greece to leave the eurozone as hopes that the world’s richest countries would stump up more cash to help the International Monetary Fund (IMF) fight Europe’s debt crisis faded.

Becoming the first member of Germany’s cabinet to openly call for a Greek exit, Hans-Peter Friedrich told that Greece’s chances of restoring its financial health would be greater outside the euro.

“I’m not saying that Greece should be thrown out but rather to create incentives that it can’t say ‘no’ to,” he added.

His comments came as eurozone leaders faced calls to increase their own efforts before any more money is made available from the IMF. Fresh from agreeing a second €130bn (£110bn) bail-out for Greece, there were hopes that this weekend’s gathering of G20 finance ministers in Mexico City would achieve a deal on how to ramp up the IMF’s own European war chest by as much as $600bn (£378bn).

UK Treasury officials made it clear that any new deal with the IMF was now likely to be delayed until meetings in April. Eurozone leaders have been negotiating with the US, China and Japan to contribute more to the IMF to build a “financial firewall” that would shield the likes of the Spanish and Italian economies from any intensification of the region’s crisis this year.

Despite fears in Washington, Tokyo and Beijing that Europe still poses a real threat to the wider global economic recovery, they want to see Europe take further steps first. America’s opposition is fiercest, with the White House making clear it won’t contribute more to the IMF. “What we don’t want to see is the IMF substitute – and it really cannot substitute – for a stronger European response,” US Treasury Secretary Tim Geithner said.

Germany also raised doubts that finance ministers would come up with a deal on IMF funding this weekend. “I expect no decision at the G20 summit on boosting the IMF’s resources,” said Jens Weidmann, head of Germany’s central bank.

Other major contributors to the IMF are insisting that Europe must combine its two existing bail-out funds as a pre-condition of any extra money from the IMF. The European Financial Stability Facility, which is worth about €250bn, will be joined this summer by the €500bn European Stability Mechanism.

“We have to take a hard look at the firewall,” said Angel Gurria, head of the Organisation for Economic Co-operation and Development. “The bigger, the thicker, the deeper and the taller it is, the more credible it will be and the less likely it will have to be used.”

European leaders will discuss whether to weld the funds together at a summit in Brussels this week. But, Germany has so far refused to say whether it would support such a move.

Mr Weidmann hit back at criticism that Europe’s largest economy was not doing enough to solve the Continent’s crisis. Germany bore a “disproportionately large share” of the financing of the two bail-out funds, he said, adding that there was a misconception the country had managed to “dodge the flames of the current crisis”.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment